America First Policy Institute

Rebuilding the American Dream: Homeownership for All Americans

Key Takeaways

« The American Dream is increasingly out of reach, as seen with the median age of first-time homebuyer reaching a record 40 years old.

« Home prices have outpaced wages, rising 150% from 2000 to 2024, while median household income grew slightly less than 100%.

« Restrictive regulations drive up housing costs— an astonishing $94,000 of new single-family home prices attributable to regulatory burdens.

« Addressing housing affordability primarily requires increasing the housing supply to address the shortage, while also correcting issues such as easing saving for home purchases, immigration, and predatory lending.

The Problem: Housing Unaffordability

Home ownership is increasingly out of reach, driven by price increases from low supply due to excessive regulations, immigration-induced demand spikes, high mortgage rates, and record debt burdens for young Americans. These limitations have severe economic and social effects, from reduced family formation to low economic mobility. Bold policy solutions to ameliorate the issue require a multifaceted approach that primarily addresses the restrictions on constructing a home, alongside policies on savings for prospective buyers, workforce development, debt, and foreign asset purchases.

Scale of the Problem & Key Supporting Indicators

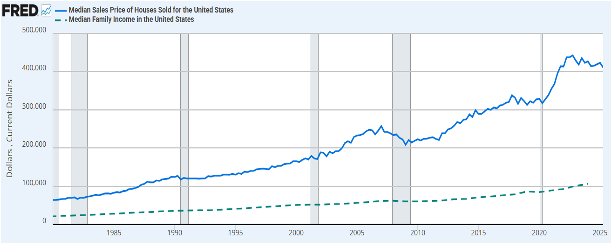

Housing prices have appreciated exponentially over several decades, increasing 167% between 1970 and 2024, 70% post-Great Recession, and 17% since the pandemic (FRED, 2025c). While home prices have risen, wages have not kept pace, making housing less affordable than ever before. As median household income increased 99.7% between 2000 and 2024, the median house sales price increased by 150.1% during the same period (see Figure 1).

Figure 1

Median Sales Price of Homes and Median Household Income since 1980

Note. Data from Federal Reserve Bank of St. Louis, 2025 (https://fred.stlouisfed.org).

Rising home prices have been especially damaging for prospective first-time buyers who face high costs entering the market and who have not had the opportunity to build wealth through home ownership. The median age of first-time buyers reached an astonishing 40 years old in 2025, a dramatic increase from 4 years ago when the median age was 33 (National Association of Realtors, 2025b). Recent wage trends among younger Americans portend a further declining market for first-time buyers; in September 2025, median income growth for prime-aged individuals reached the slowest rate since the early 2010s and has grown at a historically low rate, relative to other age cohorts (JPMorganChase, 2025).

Primary Cause: Shortage

The main cause of housing price rises is a shortage: a disparity between the existing housing stock and demand for housing, especially at affordable rates (Patel et al., 2024). When the housing supply lags behind demand, a growing number of buyers compete for a limited supply of homes, which drives up prices. Currently, the estimate of the total shortage is 5-7 million homes (Zillow Group, 2025; National Low Income Housing Coalition, 2025).

Unfortunately, for more than 15 years, housing supply has remained severely depressed. In the 2010s, the total number of new housing units constructed was lower than during any previous decade, and new housing starts have never recovered to pre-Great Recession levels (U.S. Census Bureau, 2025b). Yet in 2025, a larger share of Millennials and Gen Z report being interested, eager, and financially ready to purchase a home, more than at any point in the past (REMAX, 2025). However, the starter-home (i.e., under 1,400 square feet) market which has historically been the entry point for first-time homebuyers, has consisted of a small share of new construction. Between 2000 and 2010, starter homes still made up 13.25% of new single-family completions; from 2011 to 2024, that figure fell to just 8.29% (U.S. Census Bureau, 2025a).

Today, America is short millions of homes at the exact moment that millions of young adults are ready to buy them. The consequences are immediate and personal, as there is a growing sense that the American Dream is slipping away. Given evidence of historically low levels of construction, solutions to address the shortage should primarily focus on increasing stock by removing artificial barriers and costs to building.

Cleaning up the Previous Administration’s Failures: Trump Administration’s Early Wins

The previous administration’s policies exacerbated the cost of housing challenge, thereby pushing homeowning further out of Americans’ reach. That administration’s reckless fiscal policies, like the American Rescue Plan and the Inflation Reduction Act, led to out-of-control government spending that spurred both sharp increases in cost-of-living expenses and rampant inflation that dramatically impacted Americans’ lives. Moreover, from March 2022 to March 2024, the foreign-born population in the United States increased by 5.1 million as immigrants flooded into the United States, thereby reducing the housing supply, and further pricing out hardworking American families from homeownership (HUD, 2025).

The previous administration’s inflationary policies led to dramatically higher interest rates, with the median 30-year mortgage rates jumping from 2.8% to 7.8% and median home prices rising by over 30%. As a result, in 2024, Americans needed to make over $100,000 to comfortably afford a home, which is up 80% from January 2020 (FRED, 2025b; FRED, 2025c; Zillow, 2024). Instead of enacting policies to reduce upward price pressure, the previous administration continued to stoke the fire by introducing a nationwide rent-cap proposal and mandating compliance with the International Energy Conservation Code (IECC), which can add an estimated $31,000 in total building costs (NAHB, 2024a).

The current administration immediately prioritized undoing these actions and ushered in the passage of the Working Families Tax Cut in 2025 (also known as the One Big Beautiful Bill), which is the largest tax cut and pro-business legislation in American history. The comprehensive legislation extended and expanded income tax relief originally provided in the Tax Cut and Jobs Act, eliminated income taxes on tips and overtime, and provided tax relief for middle-class Americans and small businesses. As a result, Americans’ take-home pay will increase, better enabling them to save for homeownership.

The Working Families Tax Cut provided commonsense policy solutions to address the cost of housing. This included making Opportunity Zones permanent, which will continue incentivizing private investment in distressed communities, where OZ capital has supported the construction of more than 300,000 housing units. Separately, expanded Low-Income Housing Tax Credit provisions will help states finance more affordable rental housing, while permanently reducing the tax-exempt bond financing threshold from 50% to 25% will make it easier to develop affordable homes (H.R.1, 2025).

As a result, the current administration’s policies have helped tamp down inflation to an average of 2.7%- a stark difference from the peak of 9.1% under the previous administration. Energy prices are lower, with gasoline under $3/gallon in most of the United States, and real wages are up (The White House, 2025b). The current administration has secured early housing affordability successes through sound economic policy, and it is important that forthcoming policy complements what has already been achieved.

Impact of Housing Unaffordability on Personal and Economic Progress

Delaying Life Milestones

The skyrocketing cost of housing isn’t just pricing young Americans out of homeownership; it is also distorting the traditional path out of poverty and into stable adulthood. Quite simply, if a person cannot afford a home, he or she delays life milestones, such as marriage and starting a family. Studies have shown that following the “success sequence” can dramatically reduce a person’s likelihood of becoming mired in poverty. According to the success sequence formula, individuals who 1) obtain a high school degree, 2) work a full-time job, and 3) get married before having children are less likely to be in poverty at a later age and are more likely to achieve middle-class status. For millennials who followed this sequence, 97% were not poor when they reached adulthood (Wilcox & Wang, 2017). When housing is unaffordable, the third step of the success sequence is either delayed or abandoned altogether. Moreover, studies have shown that being married increases the probability of home ownership by 18%, and that rising housing costs are a primary driver of the reduction in births, as such a factor is responsible for over half of the fertility rate decline in the 2000s and 2010s (HUD, 2025). Surveys of young adults confirm these trends, with 84% of Gen Z saying they are delaying life milestones to afford a home (Lake, 2025).

Until the housing affordability crisis is confronted with strong America First policies, younger generations will continue to bear an unacceptable burden, thus increasing their risk of poverty. One in three Gen Z adults still lives with their parents because they cannot afford to move out (Cachero, 2023). Millions of millennials and Gen Zers are delaying marriage, postponing children, and putting entire life plans on hold simply to keep up with rent or save for a down payment that keeps moving further out of reach.

Economic Mobility and Growth

Another harmful effect of the housing shortage is that people who cannot find affordable housing are less inclined to move for new job opportunities and, therefore, cannot improve their economic standing. The consequences are twofold: an individual’s economic mobility is restricted, and the economy is stifled at the macro level, as it is harder for businesses to attract employees who do not want to move.

Over the past 35 years, data shows that Americans have moved from low-income areas to high-income areas at much lower rates, coinciding with the meteoric rise in housing prices. This is supported by low intergenerational economic mobility, which has been in constant decline since 1980 (Mazmuder, 2022). The mismatch between jobs and houses is a major detriment to local economies and is recognized by local political leaders; mayors across the country overwhelmingly cited the housing shortage as the greatest challenge to their economies (Klurfield, 2024).

Job misallocation is particularly deleterious when occurring in cities revolving around high sectors from finance to high tech, such as New York and San Francisco. When workers are priced out of these markets and remain in less productive areas, total output suffers. One study found that housing supply restrictions in 220 metropolitan areas lowered aggregate economic growth by 36% between 1964 and 2009 (Hsieh & Moretti, 2019). Even those who do work in productive areas or move for job opportunities suffer from the lack of affordable options near these areas, as an ever-growing number of low-income individuals are forced to commute, which harms productivity and output.

Drivers of Housing Unaffordability

Supply Constraints

Excessive Regulations

Burdensome regulations such as lengthy permitting processes, restrictive zoning laws, and constantly evolving building codes, are major obstacles to building new houses. These laws slow the process of construction or prevent homes from being built altogether, thus causing a major undersupply of homes, which is the preeminent factor in the housing affordability crisis. Moreover, regulatory burdens increase a home’s sale price by passing inflated construction costs.

The National Association of Home Builders (NAHB) estimated that 23.8%, or $93,870, of the cost of a new single-family home is attributed solely to regulations (Emrath, 2021). This figure continues to grow, marking a 44% increase from 2011 (Emrath, 2021). is comprised of $41,330 in regulatory costs during development and $52,540 in regulatory costs during construction. Changes to building codes, which govern everything from structural standards to energy efficiency requirements, are the biggest cost drivers, accounting for a quarter of the overall regulatory cost ($24,144). Other regulations add significantly to the overall cost of a home, from requirements that land within a lot must be left undeveloped for government use (i.e., 2.8% of home price) to architectural design standards that developers consider “beyond the ordinary” (i.e., 2.7% of home price) (Emrath, 2021).

Burdensome permitting processes also constrain supply. The NAHB study from 2021 on regulations found that the added administrative costs for zoning approval accounted for 1.6% of the final sale price, including application fees and separate payments for environmental impact assessments (Emrath, 2021). Beyond costs, the permitting process alone can be extremely time-consuming for developers, as average permitting times in recent years took 13 months in Los Angeles, 16 months in Seattle, 30 months in New York City, and 33 months in San Francisco (The White House, 2024). Even worse, a project involving federal laws such as the Clear Water Act or the Endangered Species Act triggers a separate permitting process, which can take upwards of a whole year for permit approval (NAHB, 2025a).

If delays and preventing construction entirely weren’t bad enough, permitting can significantly inflate the final cost of housing. Lengthy permitting times contribute to greater uncertainty, which leads to additional costs for developers (such as greater interest payments and additional tax and insurance payments), which are ultimately passed onto the consumer. A study from Washington state found that an additional month in the permitting process raised the overall cost of building by $4,400 (Smith, 2022).

The extreme uncertainty on timing for permitting means higher project risks, which demand that projects receive higher returns, increasing the cost of construction as a result. Moreover, permitting can dissuade developers from pursuing projects entirely. Another study from Los Angeles found that lessening permitting delays by 25% could increase housing production by 33% (Furth & Coale, 2024).

Case studies of cities that have undertaken deregulatory efforts further validate the proposition that excessive regulations are a significant factor in the affordability crisis. After streamlining permitting processes and standardizing zoning laws, New Rochelle, New York, experienced a 37% increase in housing supply over a 10-year period, with negligible price increases (Picciotto, 2025). In Austin, Texas, when permitting times were slashed and requirements to build certain amounts of parking (i.e., parking mandates) were ended, the supply of rental units increased by 14%, and consequently, monthly rents decreased by 22%, or $400 in gross reductions (Lovinger, 2025).

The Construction Industry Decline

One of the most significant contributors to the supply-side crisis is the sharp decline in construction productivity over the past six decades. Unlike nearly every other sector of the economy, labor productivity in U.S. construction has stagnated or even fallen since the 1970s (Yeh, 2025). The value added per worker in the construction sector was about 40% lower in 2020 than it was in 1970. By 2020, construction labor productivity and Total Factor Productivity (“TFP”) indexes were below their 1950 levels, while during the same period, aggregate U.S. labor productivity rose 290% and TFP 230% (Yeh, 2025; Goolsbee & Syverson, 2023). Decreasing productivity in construction means less efficient use of time, materials, and labor, which leads to more expensive homes.

As productivity attributable to workers has trended downwards, the construction industry has also faced a major labor shortage in skilled trades, as evidenced by job openings in occupations critical to homebuilding. According to the Home Builders Institute, the total job openings per year between 2024 and 2026 was approximately 9,100 for carpenters, 8,000 for electricians, 5,200 for pipelayers, 5,000 for construction equipment operators, and more than 1,000 for drywall installers (HBI, 2025). Nationally, the shortage resulted in 19,000 fewer homes being built in 2024 and a $10.8 billion economic loss, further tightening supply and pushing prices higher (NAHB, 2025c; HBI, 2025). Meanwhile, residential construction wages rose 9.9% year-over-year in late 2024 amid competition for workers—far outpacing economy-wide growth and further elevating the approximately 30% of total build cost attributable to labor (NAHB, 2025c; BLS, 2024).

As a result of the faltering labor market, nearly 10% of projects take 4 months or more (almost doubled since 2019), and the average start-to-completion time of a single-family home is 7.7 months (up from 6.2 in 2000) (U.S. Census, 2025a). More than 13% of authorized single-family units take more than 13 months to build, which is slightly below the all-time high of 18% in 2023, but still higher than historical averages (U.S. Census, 2025b). Prolonged timelines inflate overhead costs, accrue additional interest in construction financing, and heighten risks from weather and regulatory changes. In the end, all these accumulated costs simply translate into higher prices for homebuyers.

The rising cost of construction inputs is also a serious concern. The costs of materials such as drywall, ready-made concrete, and steel have all increased by double-digit percentage points since 2020 (NAHB, 2024b). Given that material costs are estimated to account for 60% of house values, increases in material costs lead to higher consumer prices (Davis et al., 2021). Coupled with an inefficient labor market and burdensome regulations at the state and local levels, rising material costs create severe supply-side implications that only drive housing prices higher.

Factors Affecting Housing Demand

Immigration and Foreign Investment

The unprecedented scale of immigrants, both legal and illegal, entering the country during the previous administration compounded the existing housing shortage through added demand pressures. Under President Biden, the foreign-born population increased by an estimated 8.3 million, eclipsing the population increase in the preceding 12 years and reaching the highest recorded share of the overall population at 15.8% (Camarota & Zeigler, 2025). This is likely a vast undercounting of the total numbers, as the Biden Administration released an estimated 7 million illegal aliens alone between January 2021 and December 2023 – a full year before the end of Biden’s term (Rector, 2024).

Between 1970 and 2024, the foreign-born population increased from 9.6 million to 53.3 million, a fivefold increase (Camarota & Zeigler, 2025). Such colossal increases in the migrant population raise the demand for housing; immigrants accounted for up to 100% of housing demand growth in some regions, and for two-thirds of rental demand growth nationwide (HUD, 2025). A sharper rise in demand leads to a shortage in supply of homes, driving the prices up. The previous administration’s illegal migrant surge underscores this relationship, as the total number of private housing units completed from 2021 to 2024 was 5.8 million, or 2.5 million less than the increase in the foreign-born population during the same period (HUD, 2025).

Government housing programs further evince the strain mass migration poses on the housing inventory. Many of these programs directly offer housing benefits to non-citizens who are not legal permanent residents (LPRs). Such examples include the Federal Housing Administration (FHA) under the previous administration offering loans to illegal aliens, or states like California offering subsidies on the down payment of a house without requiring proof of immigration status (Arthur, 2025).

Empirical evidence shows that immigration has an appreciable effect on home prices; one study found that a 1% increase in the immigration population of a Metropolitan Statistical Area (MSA) is associated with a 0.8% increase in prices for the MSA and 9.6% for surrounding MSAs, owing largely to native-born citizens moving to outlying areas (Mussa et al., 2017). Political leaders and experts have attested to the effect of the immigration surge over the past 4 years. Vice President J.D. Vance directly attributed housing price increases to illegal immigrants, saying they were “taking houses that ought by right to go to American citizens” (Fox News, 2025). Federal Reserve Board Governors Stephen Miran and Michelle Bowman (2025) have both cited immigration as a factor in the upward trend in housing prices.

In a market that is supply-constrained like the United States, foreign investors and their participation in the housing market can further worsen demand pressures. Foreign sources continue to purchase homes at record rates, buying $56 billion worth of homes in a 12-month period between 2024 and 2025, which is a 33% increase from the previous period (National Association of Realtors, 2025a). The median purchase price of these homes was $494,000, which exceeds the $408,000 for all existing U.S. homes, and 47% of foreign buyers purchased property for use as a vacation home or rental, compared to the 16% national average (National Association of Realtors, 2025a). Furthermore, 47% of these buyers, compared with 28% of Americans, paid in cash (National Association of Realtors, 2025a). The pattern of these investments means that higher benchmark prices are set for homes, while Americans who are looking for mortgages are increasingly outbid. A study found that a 1% increase in foreign capital raises house prices at the zip code level by 0.37% and that houses rose 6% to 9% more in zip codes with higher shares of foreign-born residents (Gorback & Keys, 2021). The country with the highest property ownership is China, which owns $13.7 billion in homes. Consistent trends in Chinese purchases of American real estate have had a documented effect on housing prices: between 2012 and 2018, house prices grew by 8 percentage points more in U.S. zip codes with high foreign-born Chinese populations (Keys, 2020).

Debt Burden

For younger Americans, the increasing debt burden – particularly student loans and rising debt delinquency – has become a significant constraint on their ability to purchase a home. High debt-to-income ratios directly reduce a potential buyer's capacity to save for a down payment and qualify for a mortgage, thus shrinking the number of qualified buyers in the market. Gen Z is saddled with debt, holding an average total debt of $94,000 per person (Gibbs, 2025). This figure includes student loans, which is the single largest contributor, but a large proportion of Gen Z’s debt is also derived from a combination of credit card debt, auto loans, and personal loans. With the emergence of “buy now, pay later” (“BNPL”) schemes, Gen Z’s dangerous levels of exposure to credit, especially amongst borrowers with poor or limited credit history, will remain prevalent. Moreover, it is reasonable to expect the average student loan balance for Gen Z borrowers to increase as students complete their undergraduate degrees and enroll in graduate school. For example, across all generations, the average student loan borrower has a federal student loan balance of $39,075. This number “may be as high as $42,673” when you include private student loans (Hanson, 2025).

The direct impact of student loan debt on homeownership is shocking. Studies have shown that since 2005, for every $1,000 increase in student loan debt, homeownership has declined by 1.8 percentage points for college graduates under 35 (Mezza et al., 2020). Moreover, recent surveys have only confirmed that trend, as now over 70% of non-homeowner borrowers with student debt believe it will delay home purchase, up from 63% in 2016 (Hanson, 2025).

Under the previous administration, inflation peaked at 9.1% in June 2022, placing unprecedented financial pressure on households (The White House, 2025b). In response, Americans increasingly relied on the BNPL schemes to afford everyday purchases. Despite young Americans being impacted by contractionary economic conditions and taking on swaths of debt, the data reveals that one in four Americans with credit used BNPL schemes at least once in 2022, with the borrowing profiles being low credit score individuals (CFPB, 2025). Moreover, as these poor economic conditions continued to attack Americans’ wallets throughout the term of the previous Administration, BNPL exploited struggling Americans, as they approved subprime or deep subprime loans 78% of the time (CFPB, 2025).

America’s soaring debt crisis, fueled by record student loans, rising delinquency, and the trap of BNPL schemes, has impaired an entire generation’s dreams of homeownership. High debt-to-income ratios and missed BNPL payments erode credit profiles, crush down-payment savings, and disqualify millions from mortgages. Until this debt burden is confronted head-on, younger Americans will remain renters and the dream of owning a home slip further out of reach.

Low Turnover of Homes

Another issue in the housing crisis is the lack of turnover in homeownership, defined as the share of home sales over a set period. Current homeowners, especially older individuals, are “locked” into low interest rates and do not move out of their homes, which creates another barrier for new entrants and limits supply. The last recorded annual turnover rate is the lowest since the 1990s, as only 28 homes per 1,000 changed hands, according to real estate company Redfin (Veiga, 2025). Low turnover is likely not attributable to old people having less desire to move to a new property but rather wanting to avoid refinancing at rates that are currently higher than when they purchased their homes. About half of seniors surveyed by the AARP expressed a willingness to relocate, and 70% of Baby Boomers are also open to moving into a smaller home, or downsizing (Davis 2022; NAHB, 2025b).

A major cause is the “lock-in effect,” where individuals purchased their homes at far lower mortgage rates than the prevailing rate. The average 30-year fixed rate mortgage in November 2025 is 6.27%. Eighty percent of homeowners have a mortgage rate below 6%, and over half have a mortgage rate below 4%, which means that they would risk having to finance their home at a much higher rate if they decided to move (FRED, 2025d; Farberov, 2025). Limited turnover means that new homeowners must compete for limited options, thus further increasing the shortage and price levels.

Policy Solutions to Alleviate Housing Unaffordability

To address the housing affordability crisis, policymakers should 1) form solutions based on increasing supply by removing barriers and incentivizing homebuilding, 2) provide tangible benefits to prospective homebuyers to reduce costs, 3) ease the burden of saving for home purchases, and 4) address additional issues which reduce the purchasing power of homebuyers, from immigration to predatory lending.

Knocking Down Barriers to Housing Supply

Inducing Deregulation at the Local Level

Excessive regulations that inhibit supply are one of the primary causes of the housing affordability crisis. Many of these regulations are enacted by local governments, thereby precluding the federal government from setting wide-ranging mandates to deregulate. However, the federal government, through the Department of Housing and Urban Development (HUD), can incentivize localities to expand supply by tying federal housing benefits to deregulatory practices in three key areas: streamlining permitting, eliminating burdensome environmental regulations, and removing artificial price-setting for units.

- Permitting: To improve the efficiency of permitting, localities should enact policies such as granting by right approval to developers; set a strict permitting time limit by requiring approval or rejection of a proposal within 30 days; allow third party permitters to ease the burden on local officials; prohibit changes to the plan once the right to build is granted barring a hitherto undiscovered health or safety concern; and eliminate laws that discriminate against off-site construction.

- Environmental Regulation: To address costly environmental regulation, local governments should repeal: 1) extreme energy efficiency requirements that impose harsh additional requirements outside of widely accepted standards such as the Home Energy Rating Systems (HERS), and 2) conditions that automatically trigger an environmental impact assessment (EIA) if more stringent than the federal requirements under the National Environmental Policy Act (NEPA). Localities should cut other costly progressive regulations, such as electric vehicle parking mandates.

- Artificial Price-Setting: Localities should abolish pricing measures that restrict supply and drive up costs for all individuals not covered by the policy. These policies include rent control laws, or requirements that a specified number or percentage of units in a development must be for low-income use or offered at a below-market rate.

The federal government should utilize two tactics to encourage states and localities to eliminate these construction-stifling local regulations. First, Title VII of the Civil Rights Act of 1968, more commonly known as the Fair Housing Act, enables the federal government to condition funding for every HUD program on localities’ implementation of the aforementioned deregulatory practices. The authority is found under 42 U.S. Code §3608, which requires all executive departments to “administer their programs and activities relating to housing and urban development...in a matter affirmatively to further the purposes” of the Fair Housing Act. Second, the federal government should prioritize HUD block grants to states that implement deregulatory practices.

Passed by the Senate, the ROAD to Housing Act (S. 2651, 2025) requires HUD to post best practice frameworks for states and localities, which is a step in the right direction. The Trump Administration can go further by requiring states and cities to deregulate and offering incentives for those that increase supply and assist first-time homebuyers. By encouraging deregulation at the local level, the federal government can remove deeply entrenched and costly regulations that restrict supply and drive up housing costs, thus allowing for quicker construction, more homes, and lower prices.

Incentives for Deregulated Markets

To encourage localities to undertake the deregulatory actions listed above, the federal government should offer concrete benefits to homebuilders and homebuyers only in local areas that eliminate the barriers to housing supply.

Benefit #1: TRUMP Working Families Housing Fund: A Revolutionary Approach to Inducing Deregulation

To address the undersupply of housing and housing affordability, policymakers should pursue innovative solutions and not another bureaucratic housing program. One proven market-driven solution is designed to both create housing for working families and drive housing cost reduction. By modeling policy on a private-sector workforce housing program, the federal government can deploy a tested solution immediately without the need to pilot or slowly roll out.

Amazon created a $3.5 billion workforce housing fund that financed the construction of 35,000 workforce units where the business is headquartered (Amazon, 2025). In order to reduce the impact on housing prices when Amazon located its major facilities, the Amazon housing fund provided capital to construct units for any resident living in the vicinity of its new headquarters, thereby increasing the supply of housing in the areas where the company was expanding. Importantly, the $3.5 billion does not end once it is deployed. Instead, the capital can be recycled to fund even more projects. The result is an “evergreen” structure, which is not a grant program, but rather a smart investment that continues to fund in perpetuity.

The new TRUMP Working Families Housing Fund, or the Targeted Regional U.S. Middle-Class Prosperity Fund (TRUMP), is a “fund of funds” seeded with $30 billion that could come from the proceeds of a Fannie Mae and Freddie Mac offering. The TRUMP Fund would invest in professionally managed housing funds designed to pay for the new construction and renovation of mostly for-sale and rental housing for working families in the 80% to 120% area median income, but only in communities that reduce barriers to building.

The impact can be profound, especially given that the TRUMP Fund enables private capital to be invested alongside public funds, resulting in additional funding for workforce housing. For example, a dollar-for-dollar private match totaling $60 billion would fund 650,000 new workforce housing units, with deregulatory reforms driving down costs for future projects.

Benefit #2: The First-time Homebuyer 5% Mortgage

Policymakers should create a new mortgage product for first-time homebuyers: a 5% 30-year mortgage, but only available in communities that have taken deregulated actions. A 5% mortgage rate would yield significant savings when compared to the prevailing 30-year fixed rate of 6.2%, saving $150 to $200 a month on a $400,000 loan. Buyers will receive interest assistance by HUD paying the interest to lenders in qualified markets. Congress would need to act legislatively to create a new initiative within HUD that administers the program, and appropriate funds for the interest buy-down.

Reducing Construction Costs

Promoting Skilled Trades Through Education and Workforce Development

To address the cost of labor, policymakers should aim to boost the number of workers in the skilled trades, particularly in construction related occupations. This can be done by leveraging federal funds for K-12 career and technical education (CTE) to introduce students to construction-related careers and reducing red tape in the registered apprenticeship program.

State policymakers should expand career exploration in grades 5–8 to introduce students to the skilled trades. Fortunately for state policymakers, the Perkins Grant already allows states to use discretionary funds (referred to as "State Leadership Funds" and "Reserve Funds" in statute) for this purpose. However, according to a review of the 2024-25 State Plans, only 10 states used available funds for middle grades career exploration and career development. Early exposure to careers in skilled trades could help to encourage students to pursue a related pathway in high school. Additionally, state policy makers should work with local businesses to identify high-value industry certifications that can be embedded in high school CTE programs and set a goal that every student in a construction-aligned program earns at least one industry certification. These certifications may help recent graduates transition more easily into the workforce.

At the federal level, policymakers should find ways to cut down the red tape that disincentivizes employers from taking on new apprentices, especially youth apprentices and apprentices in the skilled trades. It is estimated that, due to the current bureaucratic system, many small and medium-sized employers forgo accepting trainees, and about half of all apprentices are in unregistered apprenticeship programs (Lerman & Jacoby, 2019).

It is important to note that the recent addition of Workforce Pell Grants, established under the Working Families Tax Cut, will provide new opportunities for Americans to enter the skilled trades. Starting July 1, 2026, students will be able to use Workforce Pell Grants for short-term workforce education programs that are between 150 and 599 clock hours and last between 8 and 15 weeks. Given that there are many construction-related programs that are eligible (e.g., HVAC, plumbing, electrical), many stakeholders reasonably assume that more workers will pursue low-debt and debt-free programs in related fields using the Workforce Pell Grant, thus helping to fill labor market needs for the skilled trades nationwide. Still, as the grant programs begin within the next year, government agencies and policymakers should evaluate the program’s success and opportunities for improvement in the future.

Taken together, there are numerous opportunities at the state and federal levels to increase interest in and access to careers in the skilled trades. By increasing interest in skilled trades and reducing barriers to entry, it is possible to increase the pipeline of workers entering skilled trades and, by extension, reduce the costs of building new homes.

Opportunity Zones Plus

As described in AFPI Issue Brief “Opportunity Zones 2.0: The Next Chapter of Rebuilding America’s Forgotten Communities,” policymakers should use Opportunity Zones-style benefits to drive workforce housing in areas of greatest need. Specifically, policymakers can create a higher-tier benefit, “Opportunity Zones Plus” (OZ+), for housing constructed in designated communities that meet certain affordability requirements (Hawkins et al., 2025). The designated communities are jurisdictions where the regulatory barriers to building have been removed, as described above in “Inducing Deregulation at the Local Level.”

Removing the Permanent Chassis Requirement

The permanent chassis requirement for manufactured homes, established under the federal HUD Code in 1976, mandates that homes be built and transported on an integrated steel frame. The requirement was intended to keep manufactured homes movable and stable. However, the removal of the permanent chassis requirement for manufactured homes is a crucial step towards modernizing the regulations around these types of homes. By eliminating this burdensome requirement, manufactured homes can be delivered in more designs, such as with basements or second floors, and deployed at a larger scale with a roughly 9% cost reduction (Pew, 2025). Only 5-7% of manufactured homes are moved, with the majority now being installed on permanent foundations (Pew, 2025). This is contrary to the early stages where many were intended to be moved, but with the shift towards manufactured homes being built on permanent foundations, the chassis requirement only impedes efforts to create new housing supply, given the new expectations surrounding manufactured homes have shifted.

Direct Benefits to Homebuyers

Expand 529 Accounts to Allow for Home Purchases

Under current law, the IRS permits Qualified Tuition Plans, also known as 529 accounts, which are tax-advantaged savings plans allowing individuals to set aside funds for beneficiaries—such as children and grandchildren—to cover higher education or post-secondary training expenses, including tuition, books, and room and board. While already familiar to and utilized by many Americans, a provision that allows for 529 account funds to be used towards the down payment and home purchase if they are a first-time homebuyer, or towards their child’s downpayment and home purchase, if their child is a first-time homebuyer. Such an expansion will empower fiscal discipline among prospective homebuyers and give all Americans the opportunity to increase savings, while working towards investing in a home.

Family Formation Mortgage Credit

Young Americans delaying life milestones due to housing affordability places a generation increasingly at higher risk of poverty and disconnects them from the pride and American values of homeownership.

Federal policymakers should align family formation with homeownership by creating the Family Formation Mortgage Credit. This credit will provide qualifying families with a $10,000 reduction on their mortgage principal, delivered as a fully refundable tax credit. To be eligible, couples must marry and welcome their first child (including adoption) within a five-year window, emphasizing early family building while easing the burden of housing costs.

Building on these principles, other provisions will double the existing child tax credit specifically for married households that file jointly and either currently own a home or are actively planning to purchase one, further emphasizing the importance of the dual commitments of parenthood and homeownership. The impact of promoting marriage and economic opportunities will be substantial. Millions of young families will no longer be constrained by financial barriers as they look to build a family, and crucial American values will remain intact.

Reducing Foreign Housing Demand

15% Tax on Foreign Property Purchases

To ameliorate the problem of non-resident purchases restricting the supply of houses available and increasing prices for American homebuyers, Congress should pass a bill imposing an excise tax on the purchase of residential properties by foreigners, including non-resident aliens, foreign corporations, and foreign governments. The tax is a flat 15% rate that will be applied to the selling price of the property. Entities will be subject to the tax if they have a foreign ownership share of 50% or greater. The proceeds from the tax will go towards funding the newly proposed policy solutions to provide benefits to homebuilders and prospective homebuyers, from the TRUMP Workforce Fund to the First-time Homebuyer 5% mortgage.

The 15% figure is based on the Foreign Investment in Real Property Tax Act (FIRPTA), which taxes the gains made by foreigners from the sale or disposal of U.S. real property interests. Similar to FIRPTA, the tax will be withheld at the point of closing, in this case by a settlement agent required to remit the funds to the Internal Revenue Service. By imposing an equivalent tax on purchases, policymakers can reduce the demand for housing from foreign sources, especially for speculative purposes. As a result, more houses are available for Americans, and home prices decrease.

Cracking Down on Immigrant Demand

In terms of reducing demand by foreigners present in the U.S., the federal government should continue pursuing the mass deportation of illegal aliens in the U.S., combining law enforcement-initiated deportation and “self-deportation” efforts. Additionally, Congress and the executive branch should consider moderating immigration levels, both on immigration and non-immigration visas. Deportations and immigration restrictions can reduce the housing demand by millions of units, which would provide much-needed price relief while the long-term benefits of reduced supply barriers and increased homebuyer benefits materialize.

For the TRUMP Workforce Fund, for instance, housing vacated by illegal aliens can be replaced with modern, revitalized, high-quality, well-designed homes for working Americans in reform-ready communities. By incorporating renovation alongside new construction, homebuilders can build significantly more properties for Americans.

Wealth Building for Young Homebuyers

Cracking Down on Predatory Lending

Before young Americans can pursue homeownership and achieve the American Dream, they must get their fiscal house in order. It starts with promoting financial literacy and ending the predatory lending practices of lenders who profit off saddling young Americans with debt.

Curriculum that improves financial literacy among young Americans is as necessary as ever. Recent surveys show Gen Z has the lowest financial literacy compared to any other generation (TIAA, 2025). Moreover, with the emergence of BNPL schemes, the urgency to instill important financial knowledge in younger generations is imperative. The current environment is already dire, with more than 41% of BNPL users reporting paying late on at least one of their purchases in 2024 (LendingTree, 2025). The Departments of Education and Treasury should prioritize work to promote financial literacy and encourage states to do the same. Young Americans need to be prepared to make financial decisions later in life, and establishing fundamental skills early will only help contribute to financially sound decision making down the road.

Predatory lending practices burden young Americans with crippling debt, forcing them to delay life milestones such as owning a house. To set guardrails on the lending industry, Congress should cap the Annual Percentage Rate (APR) at 36% on most consumer borrowing, from payday loans to credit card interest. The policy is an extension of the Military Lending Act of 2005, which already caps interest at the specified rate for active-duty service members and their dependents, and is similar to existing policies in 18 states. The Federal Trade Commission (FTC) would be responsible for oversight and enforcement of the policy.

Policymakers should also review other forms of debt and lending practices that are burdensome to young Americans, such as student debt, and support policies such as tying federal loan eligibility to a school’s performance. By reducing the debt burden of the next generation, negating the effect of the predatory BNPL schemes, and setting limits to ensure that borrowing does not severely debilitate the lives of prospective homebuyers, young people can be in a more stable fiscal situation to speed up the timeline in which they purchase a house.

Conclusion

Housing affordability has reached a crisis point in America, with a 167% increase in home prices in the past half-century. The result of more expensive homes is the delay of a significant life milestone: home ownership. The average age of the first-time homebuyer reached a historic high of 40 years old in 2025. Multiple factors have contributed to the long-term price increases and growing unaffordability, chief among them being the excessive regulations which limit the housing supply, while accompanied by other factors including surging skilled labor deficits, immigrant demand, high mortgage rates, foreign investment, and growing debt amongst young Americans. The America First vision of housing affordability is to restore the American Dream to what it once was. By taking a pragmatic and targeted approach to the affordability crisis, these proposals will increase the housing supply, provide direct relief to homebuyers, bring prices down, and ultimately, allow all Americans to obtain the cornerstone of the American Dream: a place to call their own.

Works Cited