The Impacts of America First Trade Deals

Key Takeaways

« President Trump’s April 2, 2025, Executive Order 14257 established a 10% baseline tariff on global imports, adjustable up to 50% for high–deficit partners.

« Since the April 2nd Liberation Day, the Administration has announced bilateral agreements with the U.K., Vietnam, Indonesia, Japan, the Philippines and the EU.

« The proposed agreements balance a previously distorted tariff regime by having partners significantly lower (or eliminate) tariffs on U.S. goods, while the U.S. raises tariffs on their exports.

« The announced deals eliminate non-tariff-barriers which have generated multi-billion-dollar export opportunities across agriculture, aerospace, steel, automotive, and critical material sectors.

« President Trump has negotiated commitments of over $1 trillion of investment from Japan, Indonesia, the EU, and South Korea to be deployed across crucial sectors like energy, agriculture, and critical minerals.

Introduction

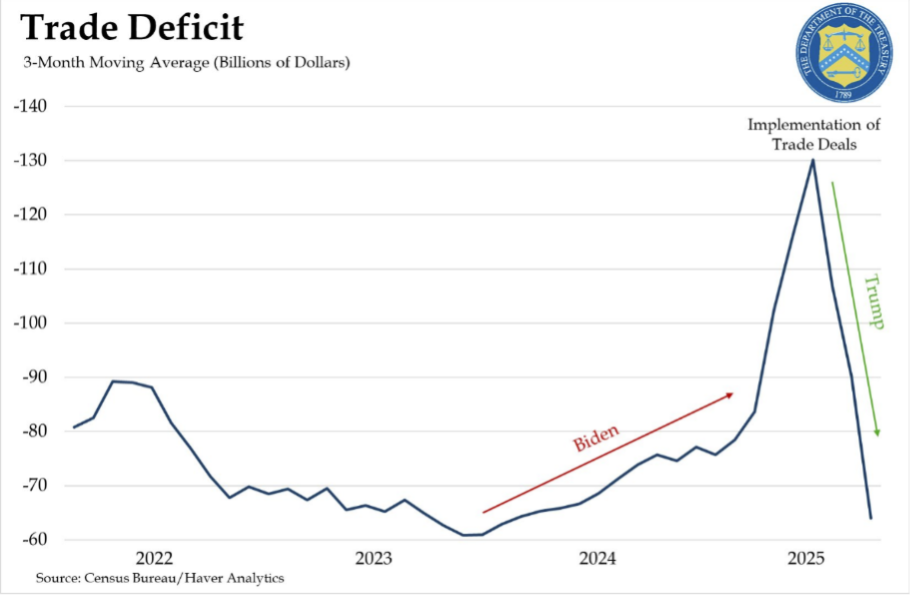

In 2024 the United States ran a $1.2 trillion goods trade deficit, the largest on record and equal to roughly 4.1% of GDP. For context, prior to the turn of the century, the goods deficit typically hovered around 1.5% of GDP. The widening gap particularly during the last two decades reflects growing trade imbalances and the steady offshoring of U.S. manufacturing, which have left supply chains, and thereby U.S. economic security, vulnerable during times of uncertainty. The trade deficit is a snapshot of structural challenges now facing American workers, including weaker domestic production, downward pressure on industry employment, and reliance on foreign manufactures. The goods deficit eclipsing $1 trillion is a stark reminder of the urgency required to begin rebuilding domestic capacity and strengthening American competitiveness on the international stage, which is why President Trump’s “Liberation Day” was so pivotal for U.S. interests.

Tariffs and the Failure of the Multilateral Trade System

Coined “Liberation Day,” April 2, 2025, was the significant action the Administration took to address the growing trade deficit. Through Executive Order 14257 titled, “Regulating Imports with a Reciprocal Tariff to Rectify Trade Practices that Contribute to Large and Persistent Annual United States Goods Trade Deficits,” President Trump announced a sweeping tariff regime, intended to finally rebalance the U.S. trade deficit. At the most basic level, a tariff is a levy placed on a product as it is imported or exported. Tariffs can be applied unilaterally by a single country, negotiated bilaterally between two countries, or governed through multilateral rules, to which the U.S. is a party, such as the World Trade Organization. Under the WTO’s most favored nation (MFN) model, members of the organization pledge to apply low level tariff rates on all MFN countries. As the WTO states themselves,

“Most-favoured-nation (MFN): treating other people equally. Under the WTO agreements, countries cannot normally discriminate between their trading partners. Grant someone a special favour (such as a lower customs duty rate for one of their products) and you have to do the same for all other WTO members.”

However, WTO trading partners have maintained high tariffs on U.S. goods, while the U.S. has imposed relatively low tariffs on their goods. Former United States Trade Representative, Robert Lighthizer pointed out the egregious deviation this statement is from reality,

“The international trading system has devolved into one of wildly uneven tariffs, rules that apply to some countries but not others, and scores of so-called free-trade agreements that in many cases codify protectionism and undermine the core WTO principle of most-favored-nation treatment.”

Under this scheme, high tariffs levied on U.S. goods make U.S. exports more expensive for overseas markets, so foreigners consume less. On the other hand, the U.S. imposing lower tariffs on foreign goods make them cheaper for American consumers, so they consume more of them. When U.S. imports of foreign goods outpace foreign consumption of U.S. goods, a trade deficit occurs (imports>exports).

Since the first term, the Trump Administration has criticized the WTO’s dispute-settlement and appellate process. As a result, the Administration has favored bilateral and reciprocal measures as an alternative, as evident by Liberation Day and the subsequent trade agreements.

Liberation Day and Bilateral Tariff Negotiations

On “Liberation Day,” the Administration began its trade negotiations by imposing blanket reciprocal tariffs, with “reciprocal” meaning tariffs set in direct response to another country’s tariff scheme and “blanket” meaning they apply to a broad range of goods. The rates were typically between 10%-20%, but high deficit trading partners, like Vietnam, faced rates up to 50%. Next, the Administration negotiated individually with trading partners interested in new trade agreements. As a result, the president has delivered sweeping trade reform which seeks to eliminate the sizeable US trade deficits, while prioritizing the American workers and foreign investment into the U.S.

U.S. companies have historically faced an unfair export environment. American exports have been consistently subjected to tariffs which have weakened the competitiveness of U.S. companies overseas and spurred the growing trade deficit. One prevalent example prior to April 2nd was American agriculture exporters looking to ship to the U.K faced an average applied tariffs of 9.2%, while U.K exporters were only subject to an average applied rate of 5% when sending their goods to the U.S.

The previous Administration did not address these deficits with U.S trading partners. As pictured below, the overall deficit rose sharply during the previous Administration. Following Liberation Day, however, the Trump administration successfully pressured countries to negotiate trade deals which prioritize American workers, companies, citizens, and addressed the deficit.

United Kingdom

The U.K. was the first country to negotiate a new trade deal with the Administration. The two countries agreed to the elimination of U.K.’s 19% tariff on ethanol, which is the U.S.’s largest agricultural export to the UK. As a result, this provision alone has created an estimated $700 million in new market opportunities.

Vietnam and Indonesia

The next countries with announced trade deals were Vietnam and Indonesia—the 3rd and 15th largest trade deficits with the U.S. in 2024 totaling $140 billion. Although Vietnam and Indonesia are both apart of the WTO and thereby grant the U.S. MFN status they imposed average applied rates of 9.4% and 8.0% on U.S. exports, respectively. On the other hand, the U.S. MFN for both countries stood at 3.3.%, After the Administration initially imposed a 46% blanket reciprocal tariff, Vietnam agreed to provide duty-free access for U.S. exports, while still maintaining a 20% reciprocal rate. Similarly, Indonesia opened its markets to over 99% of U.S. goods duty-free, while still maintaining a reciprocal tariff rate of 19%. Furthermore, both countries are still subject to a 40% tariff on goods that are deemed to be transshipped. (Transshipment is the practice of routing goods through a third country to disguise the true origin so they can evade tariffs or other trade restrictions). This is tactic often used by both China and Russa, and they tend to use Southeast Asian nations (like Vietnam and Indonesia) to do so.

European Union

Following this deal announcement, the U.S. and E.U. agreed to a trade deal. The E.U. agreed to a “zero-for-zero” tariff framework— mutually agreeing to eliminate tariffs on a given basket of products— on aircraft and aircraft related parts, chemicals, semiconductor equipment, agricultural products, natural resources, and critical raw materials. For exporters, this deal will open unprecedented opportunities to the E.U., who imported over $2.6 trillion in goods during 2024.

Non-tariff Barrier Negotiations

The announced trade deals also address unfair and burdensome government policies or administrative measures, such as quotas, import licensing, technical or sanitary standards, customs delays, subsidies, and local-content rules, that restrict import penetration and are known as non-tariff barriers. For years foreign governments have used these non-tariff barriers to make it difficult for American products to penetrate their markets at a competitive price because additional administrative and compliance costs necessary to adhere to these policies typically drive up the overall export costs. The announced trade deals have slashed many longstanding non-tariff barriers. For example, the U.K. raised its quota on American beef from 1,000 metric tons to 13,000 metric tons (2,205,000 pounds to 28,660,094 pounds) creating nearly $250 million in new market opportunities for ranchers.

Another example of a successfully negotiated non-tariff provision is with, Indonesia, which will grant U.S. industry access by exempting American firms and goods from a host of technical and regulatory barriers and will specifically waive all import-licensing for U.S. food and agriculture, grant permanent plant-product status, while recognizing U.S. meat, poultry, and dairy facility certifications. In addition, for the first time, Japan will approve U.S. automotive standards and will lift other restrictions that have long impacted American companies’ ability to enter their market. Moreover, Japan raised the rice quota by nearly 75%, providing unprecedented market access for American rice farmers. The E.U. agreed to streamlining non-tariff provisions including Sanitary and Phytosanitary Measures (SPS) rules for meat, dairy and other foods, while also providing mutual recognition of equipment testing for machinery, electronics, and chemicals.

Strategic Procurement and Investment Pledges

Important to building up U.S. domestic capabilities are the strategic investment pledges and procurement commitments that the Administration secured with U.S. trading partners. For example, Japan’s $550 billion investment commitment is designed to help bolster U.S. energy infrastructure, semiconductor fabs, critical-minerals mining, processing, and refining technology. Indonesia has committed to investing $15 billion in aerospace, agriculture, and energy industries with 100 Boeing aircraft purchases and $4.5 billion in agricultural purchases. Moreover, E.U. member states’ $750 billion investment pledge to energy procurements and $600 billion in capital investments through 2028 will strengthen supply chains. Further, South Korea’s $150 billion shipbuilding fund will push the United States closer to par with China in shipbuilding capacity.

Conclusion

The recently announced trade deals hold countries accountable for unfair trading practices and distorted deficits by improving tariff provisions, decreasing non-tariff barriers, and securing investment commitments. The Administration has unlocked new market opportunities for over $5 billion in farm exports, opened hundreds of billions in industrial market access, and attracted more than $1 trillion in foreign investment commitments.