House Reconciliation Bill Protects Students, Parents, and Taxpayers

TACKLING UNSUSTAINABLE COST GROWTH IN HIGHER EDUCATION

PERVERSE INCENTIVES IN HIGHER ED

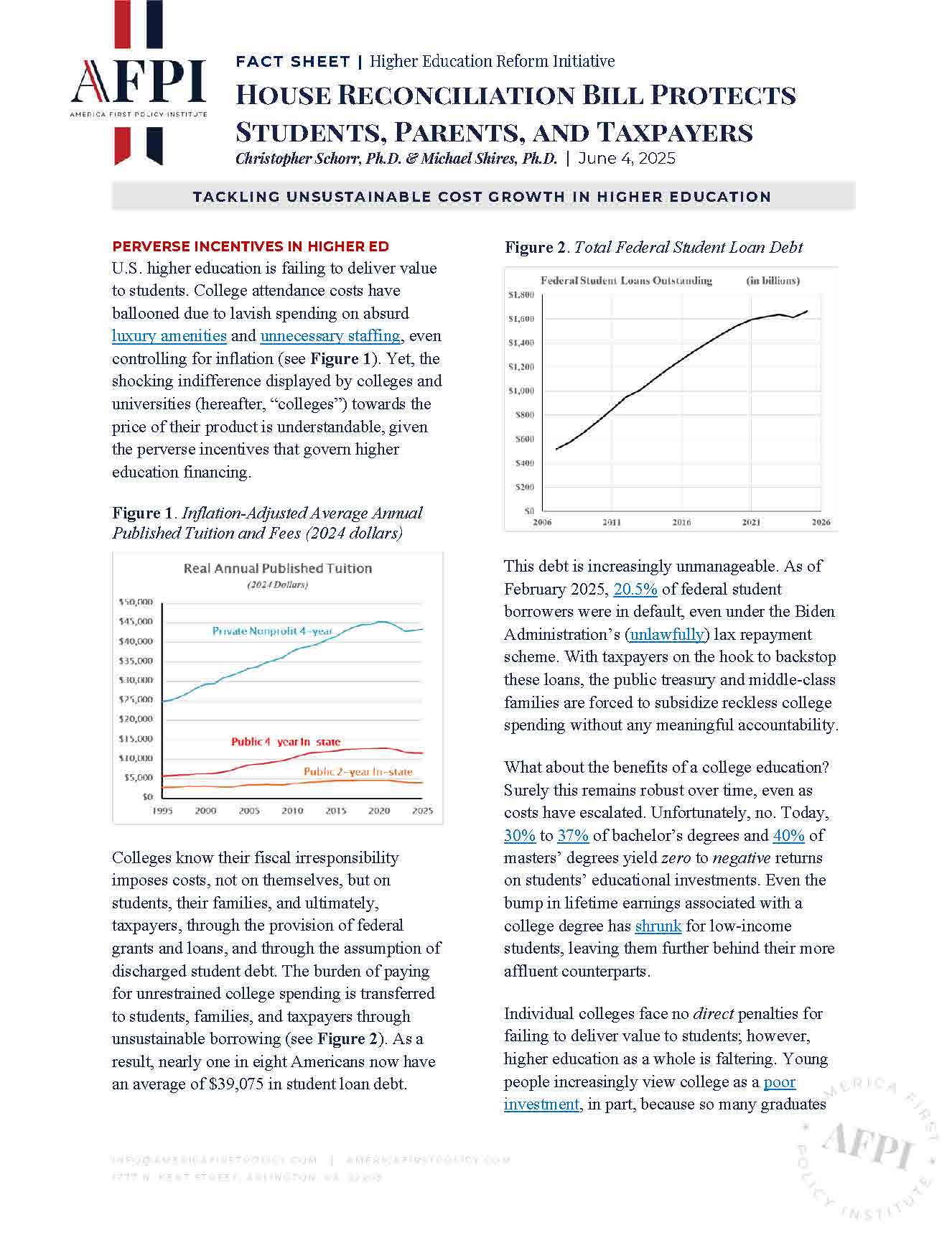

U.S. higher education is failing to deliver value to students. College attendance costs have ballooned due to lavish spending on absurd luxury amenities and unnecessary staffing, even controlling for inflation (see Figure 1). Yet, the shocking indifference displayed by colleges and universities (hereafter, “colleges”) towards the price of their product is understandable, given the perverse incentives that govern higher education financing.

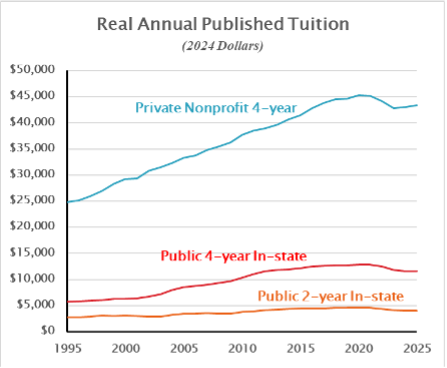

Colleges know their fiscal irresponsibility imposes costs, not on themselves, but on students, their families, and ultimately, taxpayers, through the provision of federal grants and loans, and through the assumption of discharged student debt. The burden of paying for unrestrained college spending is transferred to students, families, and taxpayers through unsustainable borrowing (see Figure 2). As a result, nearly one in eight Americans now have an average of $39,075 in student loan debt.

This debt is increasingly unmanageable. As of February 2025, 20.5% of federal student borrowers were in default, even under the Biden Administration’s (unlawfully) lax repayment scheme. With taxpayers on the hook to backstop these loans, the public treasury and middle-class families are forced to subsidize reckless college spending without any meaningful accountability.

What about the benefits of a college education? Surely this remains robust over time, even as costs have escalated. Unfortunately, no. Today, 30% to 37% of bachelor’s degrees and 40% of masters’ degrees yield zero to negative returns on students’ educational investments. Even the bump in lifetime earnings associated with a college degree has shrunk for low-income students, leaving them further behind their more affluent counterparts.

Individual colleges face no direct penalties for failing to deliver value to students; however, higher education as a whole is faltering. Young people increasingly view college as a poor investment, in part, because so many graduates are saddled with crushing debt. Public trust in higher education is at an all-time low: only 36% express a great deal or quite a lot of confidence in the sector, down from 57% in 2015.

“ONE BIG BEAUTIFUL BILL”

The House of Representatives’ sweeping reconciliation package is now in the hands of the Senate. The bill offers bold reforms to address the crisis in higher education:

- Addressing perverse incentives.

- Incentivizing universities to partner to promote student success.

- Helping students and families understand the real value of various college degrees.

- Saving taxpayers from unnecessary costs.

- Saving families from crippling debt.

- Strengthening economic growth by channeling higher education funding towards productive uses.

Critically, the House proposes risk-sharing provisions and caps on student loans to address higher education’s diminishing value proposition.

LOAN CAPS ARE CRUCIAL TO SOLVING THE DEBT CRISIS

The House proposal introduces and strengthens loan caps to protect students and their families from unsustainable education debt. These caps will additionally help to wean universities from their addiction to uncontrolled spending at the expense of students, families, and taxpayers.

Recently, concerns have been raised that student loan caps limit families’ ability to backstop their children’s education borrowing. This criticism fails to account for how these loans abuse both families and taxpayers.

Consider the Parent PLUS loan program. In last year’s predecessor to the House proposal, the College Cost Reduction Act, these loans were eliminated entirely. This was a positive provision because Parent PLUS loans are predatory:

- Parents (not students) take on these uniquely non-dischargeable loans to pay for runaway education costs.

- Parent PLUS loans are associated with high interest rates (9.08% vs. 6.53% for other federal loans) and origination fees (4.228% vs. 1.057% for other loans).

- The average default rate for Parent PLUS loans is five times greater than for other student loans (12.7% vs. 2.3%).

- In less than a decade, Parent PLUS loan debt has increased 72%.

- This debt burden is disproportionately borne by low-income and minority families.

The House budget negotiation process ultimately yielded caps on Parent PLUS loans in lieu of eliminating them. Though imperfect, this compromise represents a key step in the right direction. Increasing or lifting the caps on Parent PLUS loans would only serve to undermine desperately needed higher education reforms.

ADVANCING HIGHER EDUCATION REFORM

Other loan caps and program realignments in the House proposal similarly serve to pressure colleges to bring their costs into line with the value they create for their students.

When evaluating the House’s proposed education provisions, the Senate should be mindful that U.S. higher education is broken. Fortunately, the “One Big Beautiful Bill” goes a long way towards fixing higher education by bringing accountability to colleges, education value to students, and financial relief to students, families, and taxpayers.

THE SENATE CAN DELIVER ON HIGHER EDUCATION REFORM BY PASSING THE ONE BIG BEAUTIFUL BILL, INCLUDING THE CAP ON PARENT PLUS LOANS.